Forex Trading Signals, Complete Beginner's Guide

Have you ever felt lost when trading? Worried that a trade wasn't going to go your way? Want to branch out form crypto but unsure of where to start? How about having an army of professional traders give you tips when something major is about to go down? That's exactly what you get from forex trading signals. Professional traders will share their trade signals telling you which currency pair to buy, the price to buy at, sell targets and stop losses to protect you if something crazy happens.

This guide will walk you through everything you need to know about forex trading signals like what they are, how to get started, which signal providers to use, some of the top forex brokers, and the top tips that we suggest you follow in order to maximize your returns. So, without any further a do, let’s get into the ultimate beginner’s guide to forex trading signals.

What are Forex Trading Signals

Forex is short for “Foreign Exchange”, thus, forex trading signals are sets of instructions telling you which pair of foreign currencies to buy. A signal will typically contain the following information:

Forex pair – the signal will inform you which pair you should trade.

Buy – the signal will specify the price point at which the pair should be bought.

Sell – the signal will also tell you when to sell.

Stop Loss – in case the trade does not go as planned, the signal will also tell you where to set your stop losses, so that any potential losses can be reduced.

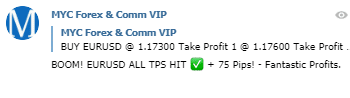

The key to getting successful forex signals, is selecting a trading group that is run by professional traders with a proven track record of success. If you’ve selected a great forex trading signal telegram group you should be making a consistent profit, and hopefully you will be getting alerts like the one below notifying you of how many pips in profit you’ve made:

Typically for the entry target, the signal provider may also give you a range as opposed to giving an absolute value. This gives traders plenty of scope to try and achieve the correct buy-in price as this would ultimately affect their resulting profit.

Forex Trading Guide to Profit

It should be pointed that you will receive instant notifications from your provider when any profit targets are hit and if the stop-loss is triggered. This is a great way of staying informed about any trades without manually having to go on to the broker and checking.

Forex signals are also not broker-specific. This means that in order to trade off a signal, you’re more than welcome to use any broker you want. The major brokers that you’ll want to be using to follow forex signals include the likes of CMC Markets, IG and Oanda.

Forex Trading Guide to Receiving Signals via Telegram

There are numerous methods of receiving signals from different groups, but by far the most popular way of getting them is through Telegram. Telegram is a messaging service mobile application that has the look and feel of WhatsApp. However, Telegram has certain unique features that sets it apart, the most important being its channel functionality. This allows members to gather in a group-like way such that the forex provider can periodically send signals through.

Another method of receiving forex trading signals is through email. Often people who are interested in generating returns by subscribing to a forex group may not have Telegram, and so, some providers do opt to send traders through email. However, the obvious disadvantage of this is that unless you’re checking your emails every so often, you may miss a signal.

Forex Trading Guide to Choosing a Signal Provider

Now that you have a better idea of what forex signals are and the methods you can receive them, we’ll now walk through how the forex signal groups are setup and the process is of joining these groups.

A large chunk of the forex trading signals community resides on Telegram. Often, you’ll struggle to find a well-designed website that communicates exactly how to join a signal group and what you can expect to get in return for purchasing a membership. Instead, the process typically is to get in contact with the admin of the signal group, who will then walk you through how to pay and join.

This is a good moment in the guide to explain how these signal providers structure their groups. Bearing in mind that these groups are all on Telegram, a typical structure may be:

Free Group – This group will contain all the non-paying individuals who are interested in signing up for a premium group. The free group typically contains the largest number of members and gives the signal provider an opportunity to show the non-paying members the amount of returns they could be making if they signed up for a premium membership. To help you get started, here's our ranking of the top free forex signal groups.

Paid Group – If you decide that you trust the signal provider, you should sign up for their premium group where you’ll receive all of their forex signals — not just the sampling offered in the free group. These groups should enable you to easily recoup the subscription cost by generating great returns. To get started trading at this level right away, we've tested out a number of free groups and put together a list of the top paid forex groups that will net impressive returns.

Educational Group – Educational groups can be free or paid. The focus of these groups is twofold: provide great signals, and help subscribers learn to develop their skills through coaching sessions. The trader or team of traders conducts live, interactive sessions in which they explain in great detail the methods behind their trades and the mental strategies they use to help them act with more discipline. These groups are a great resource for novice and seasoned traders alike. To learn more, check out our favorite new group.

Furthermore, in terms of the pricing structure, these signal providers will typically require you to pay monthly in order to have access to their premium channel. The main methods of payment include:

- Card

- Crypto

Card – The most popular payment method that most people tend to use to join a forex group is card. It’s a convenient method for many, and as such something that most high-quality groups will try to offer.

Cryptocurrency – Another method that providers will offer is crypto. Typically, you would inform the admin of the group which crypto you wanted to pay in, at which point they would then provide you with an address to send it to. Some groups also require you to send the transaction ID as further proof that the payment originated from you.

But now that you have a better knowledge of a forex signal providers and how they work, what are some of the key features of one to look out for? Of course, providers will vary depending on which one you’re with, but in general, a forex provider should have the following features:

- Notify you with updates

- Provide latest news stories

- Provide technical analysis

Notifying with you updates – We’ve briefly touched on this earlier in the guide, but a crypto trading signal provider should absolutely give you updates on any signal they’ve issued. If you decide to follow a signal but then have no idea how your trade is performing, that’s a terrible user experience. Providers will therefore ensure that they release updates on any previously issued signals whether it’s updates on if the buy-in price has been achieved, or a profit-target has been reached, you can be sure that you’ll get a notification when something important happens.

Keeping you updated with news stories – Now, some providers may not care too much about keeping their members updated on the latest news in the markets, but any provider who genuinely cares about their members will. They'll have their eyes glued to their forex calendars for any upcoming trading opportunities. It presents an opportunity for providers to comment on any news stories that may affect any signals they’ve issued. They can encourage their members to hold strong and stay in a position despite seemingly bad news, or they may encourage them to sell. Either way, a provider will be seen has having more knowledge than their members, and so will be looking for guidance on how best to navigate any uncertainty.

Providing Technical Analysis – Some people are content to blindly follow the calls of their signal provider, but if you want to know a little bit more about WHY a signal is being issued, then you’ll want to join a group that provides technical analysis. Technical analysis, or TA, is simply the use of historical trends to try to predict future price movements. These are the tools that signal providers will largely use to try to identify profitable trades. You can use the fact that whether or not a provider decides to issue TA analysis as a factor when determining the competence of the provider. If the provider posts well-thought out, and easily understandable analysis, it could be an indication that they know what they’re doing.

Why Trade Forex?

Now that you know a bit more about Forex trading, let's talk a little more about why Forex signals in particular (as apposed to crypto or even commodities) present such a great opportunity for trading.

Pros:

- Can be very profitable

- No need to conduct research yourself

- Great learning opportunity

Can be very profitable – The obvious advantage of subscribing to a forex signal providers is that if they do what they say on the tin, then they can be very profitable. Even though you may not see news stories of people becoming millionaires from these groups, they can be a great way of adding an additional $1,000 to your monthly salary. With that being said, you can only be as profitable as the provider you’re with, which is why it’s important you select carefully.

No need to conduct research yourself – The second biggest advantage is the sheer amount of time you can save. You no longer need to spend hours looking at charts or conducting research yourself when you can pay someone else to do it. As long as you’re able to generate a return greater than the amount that you paid to be to be part of the group, then it’s more than worth it.

Great learning opportunity – Subscribing to a forex signal provider gives you the opportunity to learn from those who are better at spotting profitable trades than you are. Giving the fact that so many providers do conduct technical analysis detailing the rationale behind each signal they issue, you can read these posts and try to apply their teachings for yourself. Gradually, you’ll become more proficient at spotting trades to a point where you may not even need a signal provider anymore.

But of course, for every pro there must be a con. Signals groups are great when they work, but what about when they don’t? The losses can be big. Thankfully, forex signals tend to be less volatile than crypto, but poor trades will always yield losses, and any loss is to be avoided, no matter the size. This is why it's so important to select a well-proven signals provider group before investing in signals. Here's our final recommendation for the overall top 20 forex signals providers.

Getting Started With Our Top Recommendation — @MYC Signals

Throughout this guide, we've shared several background information and several lists to help you get a sense of the different types of forex signal groups. If you want to cut right to the chase, the highest quality group that we can recommend is MYC Signals.

When it comes to producing forex signals, MYC Signals is a top-tier provider. They help their members generate sustainable returns and have a focus on consistency. This means that you can reliably predict how much returns you can expect to generate from being a member of their group.

However, they don’t just provide forex signals, they also provide signals for commodities such as oil and gold, something that very few other groups offer. This combination of both forex and commodity signals mean their members get a lot more value.

In addition, MYC Signals also post daily market and technical analysis updates so their members fully understand the decision behind every trade so they themselves can become better traders. Furthermore, their signals can be followed using common brokers and platforms such as IC Markets and Oanda.

If you want to join their group and begin your journey of generating income from their forex and commodity signals, then here’s how you can get started with them:

1) If you have telegram be sure to reach out to the admin, @MYCSupportBot, as well as to join their free forex signal group, MYC Forex & Commodities. In this group, you will receive completely free forex and commodity signals so you can see the quality for yourself. Alternatively, if you don’t have Telegram, feel free to contact them via email: [email protected] and they’ll walk you through how to get started.

2) They offer their premium channel: MYC Forex & Commodities VIP for you to join. The membership can be paid via any cryptocurrency of your choice or via card over at their payments page.

3) Once you’re all signed up and are a premium member, they’ll work with you to make sure you can follow their signals as easily as possible, as well as to solve any problems you may have. They tout 24/7 customer service so regardless of which time zone you live in, you can be sure that you’ll get a prompt response.

Conclusion

Trading signals are becoming more and more popular and we hope that you have learned something from this Forex Trading Signals Guide. These signals offer several advantages such as making your trades more consistent, saving time and a chance to learn directly from professional traders. If you’re able to find a trustworthy signal provider, then the sky really is the limit. If you select correctly, then you’ll be able to add an extra $500 or $1000 to your monthly income with minimal effort, then that in itself should been seen as a success.