Forex Crude Oil Trading Strategies

Introduction

If you’ve been trading the Forex market for a while, you’ll notice how we get some really massive momentum in the market. Quite a lot of people struggle with trading oil due to its high volatility and massive swings. But to an experienced trader, that danger represents a massive opportunity for profit.

Now, why is that significant?

When you take a look at different currency pairs, you’ll different kinds of reactions. For example, the USD/JPY market trades sideways and can be a very choppy market that overall doesn’t move around a whole lot in terms of volatility. And this is typical with most pairs in the Forex market.

In other markets, however, you’ll find out they trend more strongly than others. Markets like gold and oil tend to trend stronger than most markets in Forex. Now, what you’ll find interesting about markets like oil and gold is that certain trading strategies work better in these markets as oppose to others.

So if you’re trying to trend follow or trade momentum in certain markets, for example, the USD/JPY pair – that’s almost moving sideways or choppy – you’re going to find it difficult to follow the trend.

In markets like Crude Oil, there are certain strategies with which you could trade the markets that give you that extra edge where you can ride those trends (or momentum) and lock in an insane amount of profits.

We cover these strategies in this article but before we dive in, we need to understand… What moves crude oil? Why is crude oil such a violent mover? And what are some simple ways in which you can trade oil profitably in the Forex market.

Let's dive right in…

What Moves Crude Oil?

Crude oil is the world economy's primary energy source, making it a very popular commodity to trade. And just like any other commodity, they tend to be heavily emotionally driven. Indeed, in times of crisis crude oil demonstrates unbelievable movements.

A good example would be a crisis in the middle east, or the U.S. with Russia, or even the most recent coronavirus pandemic. In the early stages, we saw demand for Crude Oil reduce to levels never seen before.

However, this doesn’t mean that commodities always skyrocket when there's some sort of uncertainty in the market or when things begin to look scary. But a lot of times what we see is that volatility tends to increase during the time of crisis. And this is where the opportunity lies if you want to trade crude oil profitably.

Strategies for Trading Crude Oil in Forex Market

There’s a whole array of trading strategies built around trend following. The next section covers 3 of these simple trading strategies you can use to trade crude oil profitably in the forex market.

1. Moving Average Strategy

For this strategy, we use the 100 EMA (Exponential Moving Average) along with the CCI indicator with a standard-setting of 20, where above +100 is the overbought zone and below -100 is the oversold zone.

This strategy is based upon the Dow theory which states, “If there’s an uptrend in the market, keep on moving along and if there’s a downtrend in the market, keep up the short position, don’t take long entry.”

What this means is you want to always trade the trend. And if you’ve been trading the market for some time, you’ll have surely heard the phrase, “The trend is your friend.”

So How Does This Work?

What you’re looking for is the price to break and close past a significant level of resistance or support. But to spot false breakouts you won’t be taking any trade without your filter (CCI indicator). So, with the help of the Commodity Channel Index (CCI), we’re looking to identify the next cyclical trend in the Crude Oil market.

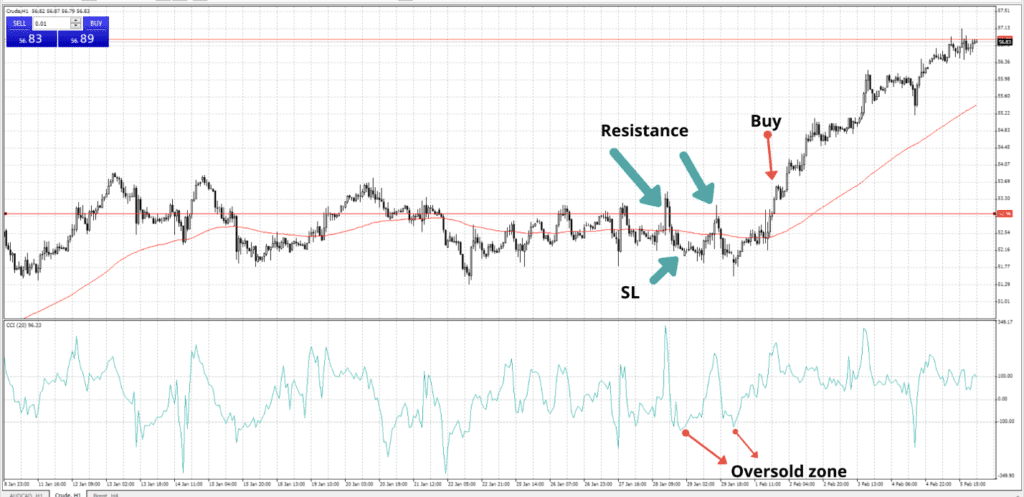

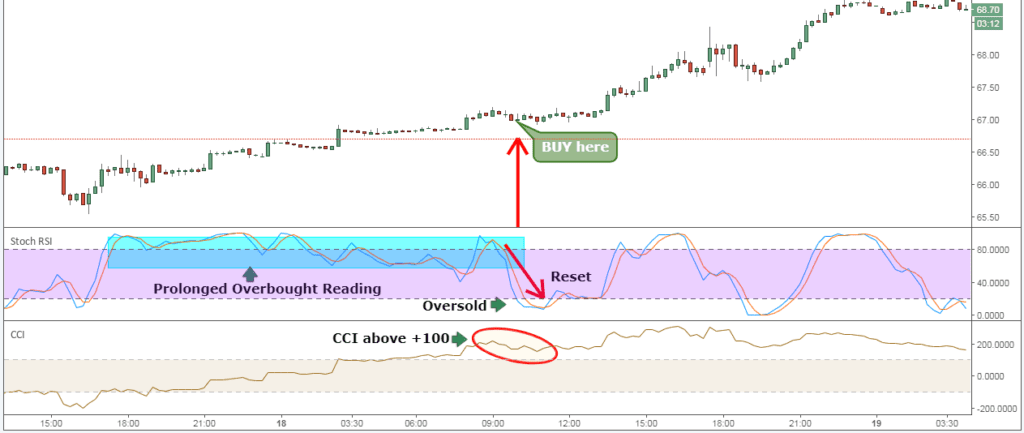

For example, take a look at the chart below…

The CCI is above +100 meaning there’s demand in the market, and looking at the moving average, you can see the market is in an uptrend. So, in this instance, you’ll be looking to go long in the market.

From the chart, we can see the price being rejected very strongly at a significant level of resistance. At this point, what we see is the market being rangebound. =

But still, the overall trend is up as we see with the moving average. So, what we want to see is buyers step in, show that demand, and push price strongly to the upside.

Now, What’s Next?

We’re looking for some kind of momentum to break past this significant level of resistance. Remember we’re not looking to fight the trend here on oil; we’re looking to ride the next trend. As sellers begin to push the price down, bringing down with them the CCI indicator to below the oversold area (-100), this is our cue to get ready to enter the market.

We are looking to go long and a great time to go long would be when you come in an oversold zone. But with this strategy, the best time to enter – that increases your chances of success – is when the CCI indicator rises past the overbought zone and price breaks past that level of resistance.

So, in this instance, we wait for buyers to show their strength and break past that level of resistance and close above it. Then we wait for the signal from our CCI indicator – when it moves past the oversold zone and climbing to the overbought zone. We want to wait for the first overbought zone before we pull the trigger.

Because that’s when smart money comes into the market. That’s all the strategy is all about.

So where do you take your entry?

Everyone trades the market differently. You can use the candlesticks to take a good entry for example, but still, this all depends on your trading plan. But with this strategy, we take our entry from the first overbought zone after we get our signal.

What about your Stop Loss?

Okay, you’ve got your trade and your risk managed, but where do you put your stop loss and take profit? Well, you have some options with where to place your SL and TP but ideally, a no-take profit would be more profitable.

Here’s why…

Crude oil is a trending market that tends to trend very strongly, and if you catch the right trend, it can be a huge mover and grow your account – if you ride the trend and have the patience to do so.

You can also use a trailing stop when the price moves in your direction. You could use 50 – 100 pips behind the trade. This way you lock in profits as the market moves in your direction.

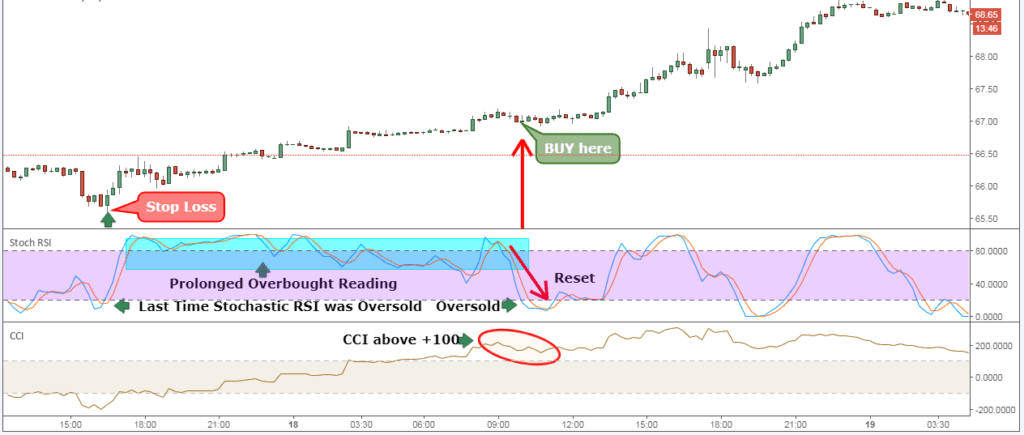

But for your SL, you simply identify the last time the CCI indicator was in oversold territory and place your stop loss in the corresponding price on the chart.

2. Breakout Strategy

When things get moving in the markets, breakouts are a great way to trade crude oil in Forex. We use the 100-day moving average with this strategy.

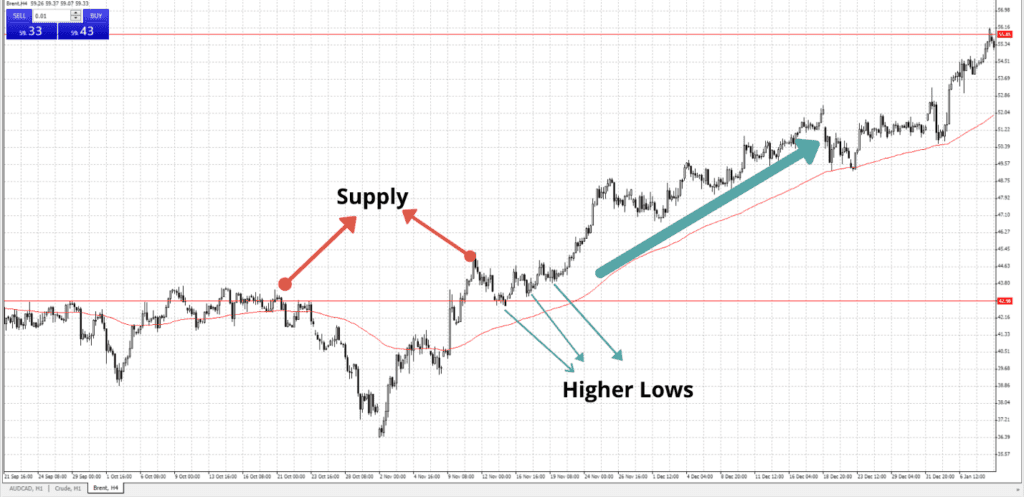

Take a look at the chart below,

What you want to try and do is identify a significant high in the market (resistance level) where the price is being rejected very strongly. Buyers are strong in this instance but sellers are forcing the price down.

Sellers come in and push the price back to the lows but then, the price starts to charter back up. But if you notice, we did see some sort of resistance again in that same significant level of resistance.

If you look closely at the chart, you could see the market is forming a series of higher lows and since the overall trend is moving up, the higher lows indicate buyers are stepping in and showing demand.

What you want to be on the lookout for is some sort of momentum from buyers. With price moving above the 100 days MA, you’re not looking to short the trend or go against it, rather you’re looking for opportunities to buy.

Now, your entry point comes down to how you analyze the market. But where do you place your stop loss? Ideally, you should place your stop loss just below the level of resistance (turn support), but again, this comes down to your trading plan and your stop-loss strategy.

And what about your take profit? There are options for taking your profit, but for a market like Oil, no take profit is a good idea. Let your profits run and trail your stops.

3. Momentum Indicator Strategy

There are several technical indicators you can choose from when trading Crude Oil. But if you want to make profitable trades, you must pick the right one. The Stochastic RSI indicator is the best indicator to trade crude oil alongside the CCI indicator.

The RSI is a momentum oscillator that tells you how strong the market is now to how strong it’s been recently and vice-versa. Combine this with CCI indicator which was designed to find the cyclical trend in the crude oil market – used as our bearish or bullish filter.

For this strategy, the preferred CCI settings are 200 periods and the preferred RSI settings are 20 periods. Technically, the best way to interpret the CCI is as follows: A positive reading above the +100 line is a bullish signal and the start of an uptrend, while the negative reading below -100 line is a bearish signal.

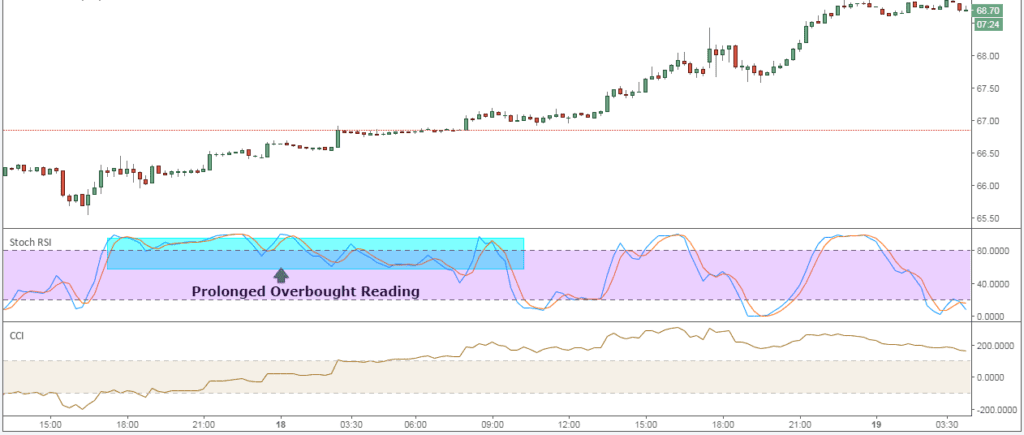

A good oil trading strategy only looks to buy on strong up days. Contrary to popular belief, when the oil market shows an overbought reading for a prolonged period, that’s a strong bullish signal.

The price of crude can be very dynamic, and this is one of the reasons why we don’t want to constrain ourselves with how long it should stay in an overbought territory to generate a valid entry signal.

But as a general rule with the RSI indicator, it needs to stay above the 80 lines during this period. When we have prices in a prolonged overbought territory, it usually means we have smart buying power on our side. With this, we can assume once the crude oil market drops to oversold regions, the smart money power will pop up again to push prices up.

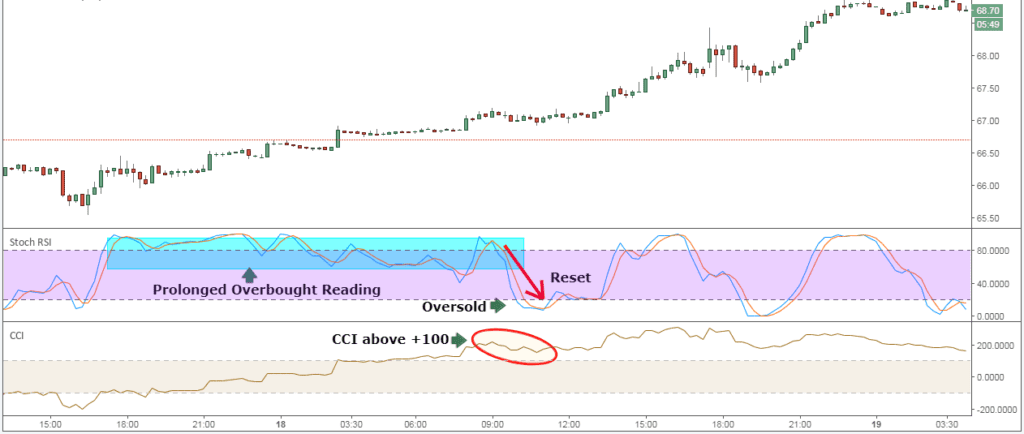

The RSI is not a magical instrument you can trade blindly, which is why to guard ourselves against the possibility of a false signal, we introduce the CCI indicator to confirm the crude oil cycle.

During the period the stochastic RSI resets, we need to see the CCI indicator hold above the +100 line. The CCI indicator holding above +100 ensures a higher probability of the trade to succeed.

Where Do We Buy?

The buy signal for this Crude oil strategy is easy to implement. We only need to wait for the fast-moving RSI indicator to cross below into the oversold zone. This is where the smart money buying power comes into the market and this is our opportunity to ride the next Crude oil cycle.

Now there are several SL strategies, but again it all depends on your trading plan. For this strategy, you simply identify the last time the RSI indicator was in oversold territory and place your stop loss in the corresponding price on the chart.

Crude oil can be a violent mover with a great potential to ride trends, due to its high volatility. That is if you ride the trend and have the patience to do so. So instead of setting profit milestones, you can ride the trend when price goes in your direction, using a trailing stop to take profits along the way.

Conclusion

The high volatility and liquidity that pours into the crude oil market, makes it one of the best commodities to trade. Unlike other markets, the oil market tends to trend very strongly.

The bottom line is that you can benefit from its volatility, but it’s important to have a trading strategy that gives you that bit of an edge, which is where trading signals come in. Signing up to receive signals from a commodities trader who offers crude oil signals can be a great investment.