Complete Guide to Leverage Trading in Forex

Forex trading is an attractive investment opportunity for many around the world, beginners and professionals alike. In fact, it offers traders additional possibilities to maximize returns and exponentially grow their capital through various powerful strategies and tools. In this article, we will discuss one such tool: leverage trading, specifically, leverage trading in forex.

The term ‘leverage’ is often used in corporate-speak and press releases to mean ‘taking advantage of (opportunities).’ However, the definition slightly differs when it comes to forex trading – although it still entails capitalizing on/taking advantage of opportunities that arise.

What is Leverage Trading?

The Merriam-Webster Online Dictionary defines leverage as ‘the use of credit to enhance one’s speculative capacity.’ Thus, leverage trading in forex simply refers to the concept of using borrowed money to enhance your trading position with the aim of increasing your gains beyond what you would have initially made had you used your own capital.

In fact, thanks to leverage trading, forex, which is well suited for day trading, offers an advantage over other financial instruments. Forex enables traders to enjoy much higher leverage than stock, meaning it is an avenue for investors to increase their returns and profits. The greater leverage stems from the fact that trading is the only way to generate income through foreign exchange markets. Thus, by borrowing money, forex traders can make more money from slight price movements, especially during day trading.

In contrast, the stock market enables traders to invest in companies and subsequently generate money from the wealth the company generates from their investment. As such, stocks are structured so that traders are not incentivized to day/flip trade.

However, while leverage trading in forex offers an opportunity to increase profits, it can potentially lead to losses, as we will detail later. In this regard, leverage trading calls for prudence, wise usage of the tool, and the need to always abide by a risk management strategy.

Leverage Trading Basics

At its core, leverage trading relies on credit, implying that a lender exists.

In leverage trading, traders usually borrow money from the very financial services company that connects them to the forex market. In short, brokers/brokerage firms offer the credit.

To undertake leverage trading, however, traders must first create a margin account with the broker.

Margin Account

A margin account is a type of brokerage account that holds securities purchased using a combination of borrowed funds and the trader’s capital. Essentially, it represents an arrangement that enables the brokerage firm to lend an investor money to trade in the forex market.

Margin accounts are so named because when the trader adds the borrowed funds to their initial capital, they are said to have bought on margin. As such, leverages and margins go hand in hand.

To open the margin account, a trader first needs to deposit a certain amount, known as the initial margin requirement (IMR), that acts as collateral to facilitate the lending. The collateral covers a certain predetermined percentage of the amount used to purchase the currencies and represents the market value of the securities. Notably, a central regulatory body or the brokerage firm itself sets the initial margin requirement.

Once a trader buys a security on margin – in this case, that would be foreign currencies – the brokerage firm calculates the investor’s capital as a share of the total value of the security. This calculation results in what we refer to as the investor’s equity. The broker then sets a minimum operating figure below which the investor’s equity should not fall. This figure is referred to as the maintenance margin.

As the name suggests, the maintenance margin allows the margin account to continue operating. If the value of the investor’s equity falls below the set limit, a situation otherwise referred to as a margin call, the broker may have to liquidate the securities in the margin account. This is why the investor’s capital is known as collateral.

Types of Leverage

There are two types of leverage:

- Margin-based leverage

- Real leverage

Margin-Based Leverage

Margin-based leverage is based on the initial margin requirement set by the broker. With this in mind, it is also worth pointing out that the margin requirements vary from one broker to another. Additionally, the IMR changes based on the currency pair.

Before explaining what margin-based leverage is and how to calculate it, let’s first put the IMR into perspective. Let’s imagine that Broker A has set the IMR for the CAD/JPY currency pair as 2%, and you wish to trade a mini lot of this pair, which is equivalent to CA$10,000, the minimum capital you need to deposit in order to create a margin account with Broker A would be CA$200. In this case, the margin-based leverage would be 50:1.

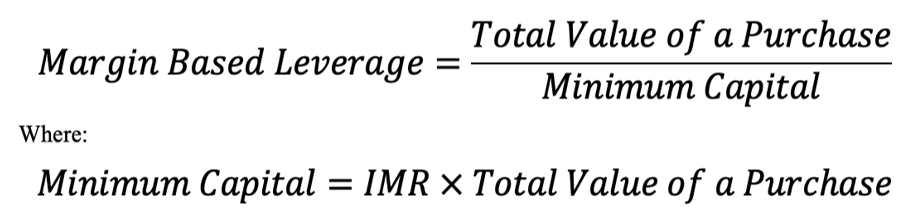

In this regard, margin-based leverage refers to the ratio of the total value of a purchase to the minimum capital. Where the minimum capital is the product of the IMR and the value of the purchase. This is summarized by the equation below:

The table below summarizes margin-based leverages, expressed as ratios and their corresponding initial margin requirements.

| Margin-Based Leverage (Ratio) | Initial Margin Requirement (IMR) |

| 100:1 | 1.0% |

| 50:1 | 2.0% |

| 33.33:1 | 3.0% |

| 25:1 | 4.0% |

| 20:1 | 5.0% |

| 16.66:1 | 6.0% |

Real Leverage

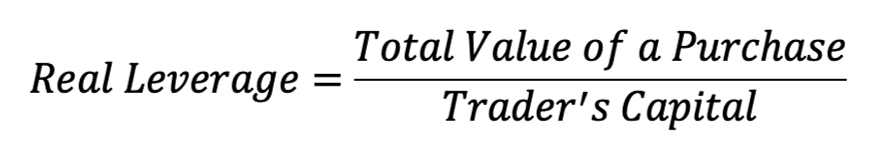

Real leverage refers to the ratio of the total value of a purchase to the trader’s capital. Notably, the trader’s capital is also known as the minimum capital.

The real leverage is denoted as a whole number, e.g., 10, 20, 50. If the real leverage is 10, we say you are trading with 10X leverage on your margin account.

Let’s put this equation into perspective and figures into perspective. For example, if your margin account has US$1,000 (your contribution to the capital), and you intend to open a position equivalent to a mini lot (US$10,000), you will calculate the real leverage by dividing $10,000 by $1,000. This would give a value of 10, meaning you will be trading with 10X leverage.

Similarly, if your capital is $20,000 and you intend to open a position equal to a standard lot ($100,000), you will be trading with 5X leverage on your margin account.

How Leverage Trading Works

If you hold a margin account with a broker that offers 100:1 leverage, depositing a capital of $1,000, this would mean that you can trade a maximum of $100,000. Similarly, if the broker provides a 50:1 leverage and you deposit capital of $5,000 in your margin account, the maximum position size would be $250,000.

Notably, the real leverage also works similarly. A 10X leverage on your margin account essentially means that your initial capital is multiplied by 10 to yield the maximum position size.

Profit or Loss Potential in Leverage Trading

Based on the description, leverage trading offers an upside. It amplifies the capital in a way that creates a position size way larger than what the trader initially had. In doing so, this concept makes it possible for the trader to make larger profits. However, while this may be the case, it also means that a larger position size magnifies the losses.

So, how do profits and losses stack up in the world of forex trading?

Case Study

Let’s take the example of the GBP/JPY currency pair. If a trader wishes to trade a standard lot of the base currency (£100,000) using an initial margin of £20,000 deposited in a margin account offering a 25:1 margin-based leverage, they would be working with a maximum position size of £500,000.

If the trader enters a position involving the GBP/JPY currency pair at 152.00 using the maximum position size, every change in pip would be equivalent to £32.89, calculated using the following formula: [(£500,000*0.01)/152.00]. (The maximum position size is multiplied by 0.01, which is equal to 1 pip).

However, the GBP/JPY normally experiences severe price movements that involve hundreds of pips, sometimes as much as 300 pips in a single day. In most cases, though, the price swings are limited to a maximum of 100 pips. Considering the 100-300 pips range, the trader could gain or lose between £3,289 to £9,867, or between 16-49% of the initial margin/capital.

In this regard, leverage trading could go both ways depending on whether your trades are positioned correctly. The potential to lose is just as high as that related to making profits. What makes the losses in leverage trading even more severe is the fact that you could lose as much as 50% of your initial capital, depending on the propensity of a currency pair to experience price swings, in just a single trade.

How to Mitigate Against Losses in Leverage Trading

The loss as a percentage of the initial margin/capital described in the case study above is unacceptable in trading. It is impossible to avoid losses altogether in forex trading. Even so, is paramount that traders use methods and strategies that keep the losses at a minimum.

Normally, stop-loss orders are preferred, even in leverage trading. Being orders that are placed, either manually or automatically, when the quote currency reaches a particular price, the stop-loss orders help the trader minimize the magnitude of the losses. That said, what would constitute an acceptable loss in leverage trading.

Well, an acceptable loss ranges between 2-3% of the initial capital. Thus, if a trader has deposited $10,000 as initial margin in a margin account offering 10X leverage, 2-3% would translate to a range of $200 to $300. If the trader works with a maximum position of one standard lot ($100,000), they would need to use a stop-loss order of between 20 and 30 pips to keep the loss at a minimum of 2-3% of the initial capital. If the quote currency goes beyond this number of pips, the stop-loss order will trigger a sale.

To calculate the possible loss (or profit) associated with any number of pips, traders can simply find the product of the maximum position, the value of one pip, and the number of pips as in the equation below. Notably, price movements in forex are represented by pips; every pip has a value of 0.0001 for all currencies, except for the Japanese Yen, whose pip equals 0.01.

Importance of Leverage Trading

To appreciate and understand the importance of leverage trading, consider that price movements in forex are measured in pips. In this case, a pip represents a value of 0.0001.

Thus, if a currency pair moves 50 pips, that would translate to a price movement of 0.005. This is a relatively marginal figure, especially if the capital invested is considerably small. For instance, a trader who invests $1000 would simply earn $5 in profit. However, if the same trader invested $100,000, that would translate to $500 in profit for 50 pips.

In this regard, leverage trading helps traders magnify their profits by taking advantage of small price movements.

At the same time, the traders need to consider the possibility of making losses. Stop-loss orders are, therefore, necessary.

Conclusion

Leverage trading is one of the concepts that make forex trading attractive. It helps traders magnify their profits by taking advantage of small price movements. Leverage simply entails borrowing funds from a brokerage firm in order to trade using the maximum position size available. However, while leverage trading offers an opportunity to magnify profits, it could also result in losses. Traders should, therefore, use stop-loss orders to limit their losses to an acceptable range of 2-3% of their initial capital.