What is Wrapped Bitcoin (WBTC)? A Detailed Guide

Wrapped Bitcoin (WBTC) is an ERC20 token that is designed to act as a 1:1 representation of Bitcoin on the Ethereum blockchain. Wrapped Bitcoin is intended to capture the benefits that can result from the tokenization of the Bitcoin cryptocurrency, such as integrating Bitcoin’s liquidity with Ethereum-based decentralized applications (dapps) and decentralized exchanges. Wrapped Bitcoin can also be considered as being a DeFi (decentralized finance) project, because capturing Bitcoin’s liquidity on the Ethereum blockchain could facilitate the wider adoption of Ethereum-based DeFi applications that operate in areas such as: lending, decentralized exchanges, payments and more.

Asset tokenization can produce a number of advantages, such as:

- Increased transaction speeds – assets that are tokenized can benefit from fast transaction execution. For example, a transaction that is executed with Wrapped Bitcoin, that utilizes the Ethereum blockchain as the transfer medium, would execute faster on the Ethereum blockchain than the Bitcoin blockchain.

- Usability – Wrapped Bitcoin is a token that satisfies the ERC20 technical standard, a standard that has seen its adoption by numerous exchanges, dapps and wallet providers in the ecosystem. This provides added usability to Wrapped Bitcoin, as it too can enjoy the products and services that support the ERC20 technical standard.

- Greater liquidity – the digital asset of choice when it comes to trading ERC20 tokens, or interacting with dapps, is Ethereum. However, Bitcoin possesses significantly more liquidity than Ethereum, thus, introducing a tokenized Bitcoin to the Ethereum blockchain, such as Wrapped Bitcoin, serves as an opportunity to introduce greater liquidity when trading ERC20 tokens or interacting with dapps.

Wrapped Bitcoin (WBTC) Model

With Wrapped Bitcoin, one unit of WBTC is backed by an equivalent unit of one Bitcoin. The process of backing a digital asset can be achieved in a number of ways, for example: algorithmically or in a centralized fashion.

- Algorithmic – with this method, smart contracts are used to control the supply and demand of the token, so that its price can be kept in line with the asset that is backing the digital token.

- Centralized – with the centralized model, the asset backing the token is stored with a centralized organization. The organization will mint or distribute tokens that equal the number of assets that are backing the token, with the organization also publishing proof of reserves to show that the organization does in fact hold the equivalent number of assets backing the minted tokens in circulation. Examples of this model include: Tether and USD Coin (USDC).

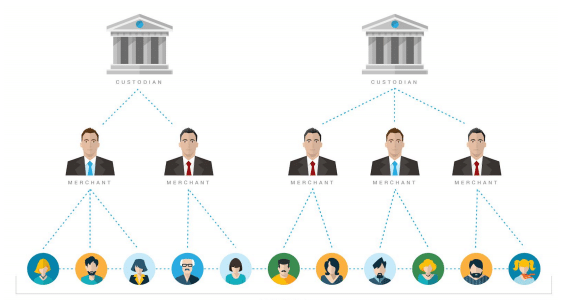

Wrapped Bitcoin has adopted a variant of the centralized model. Instead of relying on one entity to take on the responsibility of maintaining assets and underlying tokens, with the Wrapped Bitcoin model, maintenance is carried out by a consortium of entities that each perform different roles on the network.

Network Roles

The roles that this consortium of entities must play on the network can be subdivided into the following:

- Custodian – this is the entity or party that will hold assets (both WBTC and BTC). The custodian will be responsible for exchanging wrapped bitcoins for bitcoins, via a minting process, and also redeeming bitcoins in exchange for deposited wrapped bitcoins, done through a burning process. The role of the custodian will be played by BitGo, a custody solutions provider for digital assets.

- Merchant – merchants are the parties to which wrapped tokens will be minted to, and burnt from. Thus, merchants play a significant role in the distribution of Wrapped Bitcoin tokens. Each merchant holds a key that allows them to initiate the minting and burning of Wrapped Bitcoin tokens. Token exchange protocols, Kyber and the Republic Protocol, will play the role of merchants on the network.

- WBTC DAO Member – the addition and removal of custodians and merchants on the network will be controlled by a multi-signature contract. Key holders to this contract will be held by entities on the network to form the WBTC DAO.

Participating custodians of Wrapped Bitcoin are expected to have a pooled wallet to support merchants. The wallet will be used to send funds to on-chain merchant addresses that are whitelisted. The wallet will also be configured with a multisignature set-up, with the keys to the wallet being controlled by the custodian.

Users of Wrapped Bitcoin can acquire more of the token through the merchants on the network. Individuals can use Wrapped Bitcoin like any other ERC20 token in the Ethereum ecosystem.

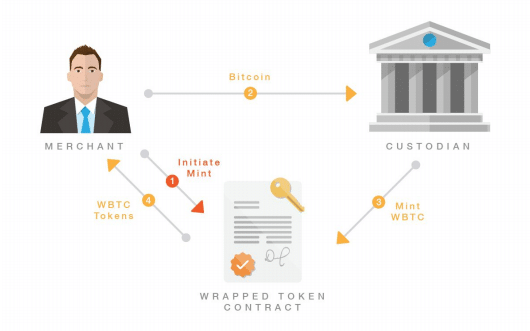

Minting Wrapped Bitcoin (WBTC) Tokens

Minting is the process by which new Wrapped Bitcoin tokens are created. Minting of Wrapped Bitcoin tokens are executed by a custodian, but the process of minting must be initiated by a merchant. Minting is a process that occurs strictly between the custodian and merchant, the user is not involved in this process.

The minting process is as follows:

Steps for minting WBTC

- The merchant initiates a transaction that authorizes the custodian to mint and deliver X WBTC to the merchant’s whitelisted address on the Ethereum blockchain.

- The merchant will then send the custodian X BTC. The number of bitcoins sent to the custodian will equal the amount of WBTC that is sent to the merchant’s address.

- The custodian will wait for 6 confirmations of the BTC transaction, which signals that the transaction is effectively irreversible.

- The custodian will then create a transaction to mint X new WBTC tokens to the merchant’s address.

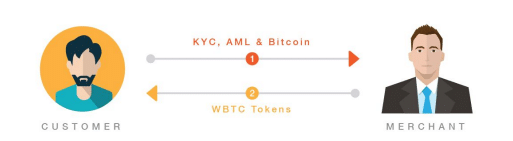

Steps for Users to Exchange BTC for WBTC

As mentioned earlier, users are not involved in the minting process, thus, they must acquire WBTC tokens through a merchant:

- User requests WBTC from a merchant.

- The merchant will carry out KYC and AML procedures in order to verify the identity of the user.

- The user and merchant will then perform an atomic swap, in which the user receives WBTC in exchange for their BTC. Users can also use an exchange that they trust to exchange their BTC for WBTC.

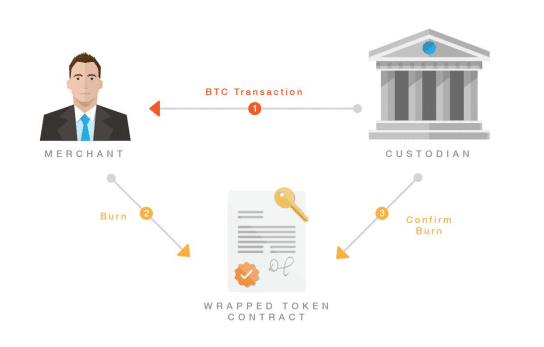

Burning Wrapped Bitcoin (WBTC) Tokens

Burning refers to the process in which WBTC tokens are burned and redeemed for BTC. Only merchants are able to burn wrapped bitcoin tokens, and the steps for the burning process are as follows:

- The merchant will initiate a burn transaction on the Ethereum blockchain, burning X WBTC tokens.

- The custodian will then wait for 25 block confirmations for this burn transaction, to signal that the transaction is effectively irreversible.

- The custodian will then release X BTC to the merchants Bitcoin address.

- The custodian then makes an Ethereum transaction to mark that the burn request has been completed.

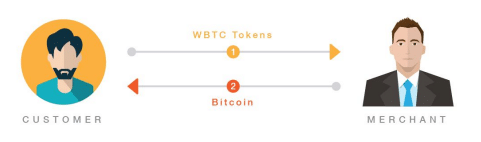

Steps for Users to Exchange WBTC for BTC

In order for a user to exchange their WBTC for BTC, they can do so via a merchant on the network:

- User will firstly request the redemption of tokens from a merchant.

- The merchant will carry out KYC and AML checks to verify the identity of the user.

- The user and the merchant will then engage in an atomic swap, where the user will receive bitcoins in exchange for their WBTC tokens. The user can also choose to execute the transfer of WBTC for BTC on an exchange that they trust.

Wrapped Bitcoin (WBTC) and Sidechains

In the initial phases, the Wrapped Bitcoin token will be launched on the Ethereum blockchain. However, the Wrapped Bitcoin team recognizes that the increased adoption of Ethereum could see the cost of executing transactions and creating dapps on Ethereum rise to a point where it becomes too expensive to carry out these activities. Thus, if this scenario arises, then there is the possibility of introducing a pegged sidechain to deal with any increase in transactional throughput.

Existing software that allows for pegged sidechains, such as parity-bridge, can be run by DAO members. It is planned that this sidechain will operate on its own proof of authority network, using the Aura consensus algorithm. Benefits that can be captured from leveraging sidechain technology include:

- Increased throughput, which allows for more scaling.

- Minimal transaction cost (transaction cost will exist to prevent spam transactions).

- Easy to support with existing clients and wallets.

It is planned that Wrapped Bitcoin will be the first asset to be deployed on any future sidechain, and alongside this sidechain, will be a suite of components to foster the creation of an ecosystem. These components include:

- Node Software and Configuration

- Block Explorer

- Wallet Providers

- Block Validators

- Multi-sig Authorities

Governance

The governance model adopted by Wrapped Bitcoin is that of a DAO (Decentralized Autonomous Organization). The token contract that pertains to Wrapped Bitcoin is governed by a multisignature contract in which signatures are required from DAO members in order to add or remove entities. All custodians and merchants are able to become DAO members, however, entities that are not custodians or merchants can still become a DAO member.

With the multisignature contract set-up, an M of N signature will be used, where M is the required number of signatures and N is the total number of DAO members. The values that are to be attached to M and N is decided between DAO members.

Trust Model

The Wrapped Bitcoin model arguably does require trust to be placed in participating entities. For example, custodians are trusted not to steal stored assets. The wrapped token model attempts to minimize this trust in a few different ways:

- Custodians are not able to mint their own tokens. The process of minting can only occur if it is initiated by a merchant. Thus, control of token creation is shared between the custodian and the merchant.

- Quarterly audits by independent third parties are promised to be conducted in order to verify that all Wrapped Bitcoin tokens that are minted have an equivalent number of bitcoins that are stored in custodian wallets.

Fees

The fee model of Wrapped Bitcoin is such that the transfers of WBTC between users will have no cost apart from network fees. This network fee can be further subdivided into the following three categories:

- Custodian fees – this fee will be taken by the custodian when a merchant initiates a minting or burning of Wrapped Bitcoin tokens.

- Merchant fees – this fee is taken by the merchant when the user seeks to exchange bitcoins for Wrapped Bitcoin tokens, or when they want to exchange their Wrapped Bitcoin tokens for bitcoins.

- Sidechain transaction fees – this fee is primarily intended to prevent spam transactions on the sidechain network. Sidechain transaction fees will be equally shared amongst all entities that are running nodes on the sidechain.

Transparency

The Wrapped Bitcoin model will also be accompanied by high levels of transparency. Details that will be made transparent will be reflected in the dashboard. Details that will be made transparent include:

- Names and details of entities that are performing different roles on the network.

- Status of mint and burn orders (e.g. pending, processing, cancelled, complete).

- The total of bitcoins that are stored by custodians on the network.

- Total amount of Wrapped Bitcoin tokens in the network. This figure should be the same as the number of bitcoins stored by custodians or slightly lower.

- Quarterly audits in the form of transactions which prove that the custodian has the keys to the stored bitcoins.

- Merchant and custodian Ethereum addresses.

- The bitcoin address that will be associated with each merchant, and also the bitcoin address controlled by the custodians.

- Links to the open source token contract code and deployed contract on a block explorer.