The Top 5 Crypto Trade Journals

As a crypto trader, if you want to improve and make consistent gains, you’ll need a system in place to make reviewing your trades a habit. A crypto trading journal is a profitable traders’ secret weapon. This article will show you how you can implement one for yourself and take your trading to the next level.

The fact that it takes time to understand yourself as a trader can make the early stages overwhelming. And rightly so. Cryptocurrency trading – like any other kind of trading in the financial markets – can be somewhat of an emotional roller-coaster, especially if you are a beginner. For one, you might not know how to use the various tools that exchanges provide. Secondly, the internet is awash with information and tips on how to trade and, given your inexperience, you might not know what to trust and how to use the info.

Trading can also be overwhelming even for a seasoned trader. They still need to remain grounded in their decision-making process to protect themselves against losses. Fortunately, though, professional traders have tricks that prevent them from making decisions borne from irrational excitement and erratic thoughts. It is what captures their trading principles and secrets. This trick forms the subject of discussion in this article – the crypto trading journal.

This article will define the term crypto trading journal and discuss the top 5 crypto trading journals in the market currently. Let’s get into it.

What is a Crypto Trading Journal?

A crypto trading journal is a record of the trades you, as a cryptocurrency trader, make and the reasons behind them. The rationale behind keeping a crypto trading journal is to track the performance and logic behind all your trade, in effect, justifying every move.

This vital tool eliminates guesswork and gives you a template that helps you identify your trading principles. Without it, cryptocurrency trading would be akin to gambling. Simply put, a crypto trading journal brings planning, reflection, and consistency together.

Benefits of a Crypto Trading Journal

The benefits of having a crypto trading journal include the following:

-

It helps you develop working strategies, thereby teaching you how to trade successfully.

-

It enables you to keep your emotions in check.

-

It facilitates growth anchored on performance.

-

It delineates your strengths and weaknesses.

-

It helps you avoid impulsive or unplanned trades.

These benefits result in successful trades. They make having a crypto trading journal a must-have for beginners and professionals alike. In fact, in major trading companies, the standard practices require analysts to log their trades and why they made them. Essentially, such companies advocate for trading journals. But how do you record your moves like these pro analysts?

How to Journal

A good crypto trading journal has the following elements:

-

Date and time.

-

A screengrab of the trading chart showing the trend.

-

Reason for trading, whether entry or exit.

-

Various prices, i.e., the stop-loss price, take profit, and entry price.

-

The risks involved.

-

Your position size, i.e., the number of crypto coins for that trade.

Although not all these elements have to be in your crypto trading journal, it pays to have most of them. They work collaboratively to tell a story. A story that ultimately defines your trading principles and strategies. If you opt to track your trades using Google sheets or an excel spreadsheet, you can include these elements as your column titles.

However, crypto trading journal spreadsheets and Google sheets are somewhat disadvantageous. They require you to record everything manually by yourself. This, while possible, can be counterproductive, especially if you are dealing with multiple trades, open positions, and cryptocurrencies. Recording each entry is bound to keep you occupied and can distract you from making important observations.

Fortunately, professional crypto trading journal providers exist. But choosing the right/best service provider could, again, prove difficult. This is why, in this article, I’ll help you out by discussing the top 5 best crypto trading journals in the market.

Top 5 Crypto Trading Journals

1. Coin Market Manager (CMM)

Coin Market Manager is primarily a portfolio manager. But it doubles up as a crypto trading journal that offers interesting and useful features, which make it stand out among all the other platforms listed herein.

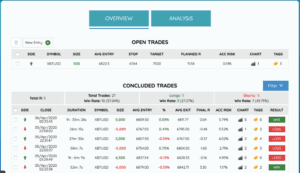

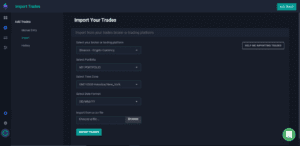

For starters, when you create a new journal on Coin Market Manager (CMM), it prompts you to upload your trades manually or use its automated feature. The latter relies on CMM’s API manager that links your account on any supported exchange to your CMM account. Upon creating the new journal, CMM automatically categorizes your trades into “Open Trades” and “Concluded Trades.”

Thereafter, on your open position(s), CMM prompts you to enter the target price (the exit price) and your confidence level. It then calculates your risk. You can also upload a screenshot of the candlestick chart from your exchange that informed the target price and tag the screenshot with a reason for the trade. On the backend, this and other tags are used to create tag-based graphs summarizing all transactions made using the reason mentioned in each tag.

CMM also offers these additional features:

-

Math lab: allows you to calculate various parameters such as the consecutive loss percentage and risk associated with a trade.

-

Performance graphs and reports.

-

Notes: This tab shows the uploaded screenshots and additional reasons you may have typed while entering the trade.

However, most of the useful features on Coin Market Manager are only available for paid plans. The free plan only allows you to enter trades manually, use the math lab tool, and link your CMM account to only one exchange.

2. CryptoJournal

CyptoJournal offers many useful solutions that make trading easy and the learning process associated with analyzing records a breeze.

It was created as a collaborative effort involving a group of traders, programmers, and entrepreneurs. Their guiding principle was that, although trading journals used in other financial markets exist, their solutions are not suited for crypto traders. CryptoJournal is tailored to meet the demanding needs of crypto trading and the volatility of the market.

CryptoJournal has the following features:

-

Performance graph.

-

Smart journal.

-

Calculator tools, e.g., position size calculator, average price calculator, fee calculator.

-

Emotion tracker.

-

Screenshot upload option.

The graph summarizes your trading history and updates whenever you close a particular trade. This tool enables you to track your performance and the lessons learned from trading.

The platform’s dashboard also helps you monitor trades you have already made and those you missed since you can upload both of these on the website. It also allows you to review the exact days, weeks, and months you trade. In doing so, you get to identify a pattern, the mistakes made, and lessons learned according to the date.

The screenshot upload option provides a visual basis for your decision-making, enabling you to understand the reasoning behind each trade. CryptoJournal also goes a step further by providing tips that highlight when it is appropriate to enter a trade, emotions that result in losses (emotion tracker), unprofitable/loss-making trades, and what to focus on to earn more/increase your wins.

However, all these features come at a cost. CryptoJournal does not have a free subscription. Every user has to pay a subscription fee, depending on the chosen plan, i.e., monthly, 3-months, or annual. Additionally, the platform is not as robust and reliable as the web copy purports. You are likely to experience some downtime, especially in the registration phase.

3. TraderSync

Although TraderSync markets itself as the ultimate stock trading journal, it still enables you to record and track cryptocurrency trades. You can add a trade either manually or by importing a .csv file. You have to specify the broker or trading platform you conduct your trades on while importing the file.

TraderSync is a very user-friendly platform that is easy to understand. It is available as a website and as a smartphone application. As such, with this crypto journaling platform, you can journal on the go.

TraderSync offers the following features:

-

A dashboard that displays your open and concluded trades.

-

Reports.

-

Performance evaluator and manager.

-

Mistakes/notes section. You can mark trades you consider mistakes.

TraderSync is available in three different plans: free, pro, and premium.

4. Trading Journal Spreadsheet (TJS)

Trading Journal Spreadsheet (TJS) uses MS Excel. It is a spreadsheet with pre-built formulas and pre-defined column headings that describe what entries the column should have. The table is divided into sections, e.g., identifiers, entry, exit, result, tracking codes, etc. Under the identifiers section, you will find column headings such as the account name (the exchange you’re using), cryptocurrency symbol, trade position (whether long or short), and entry date. The other sections follow a similar pattern.

Besides recording trades, the Trading Journal Spreadsheet also enables you to analyze the trades to establish their performance and identify trends. The analysis sheet consists of tables summarizing various aspects of crypto trading. These tables show the following performance tracking categories:

-

Trades that you lost or won.

-

Your performance according to the days of the week.

-

Each crypto’s performance.

-

Exit strategies.

-

Entry strategies.

-

A summary of mistakes made, their frequency, and how much they cost you in earnings.

This crypto trading journal is available at a one-time fee that ranges between $119.99 and $179.99, depending on the number of markets you intend to journal using TJS. It also supports other financial instruments, i.e., stocks, forex, futures, options, and contract for differences (CFDs). However, it is less user-friendly than other crypto trading journals because it is merely an Excel spreadsheet.

5. MyCryptoJournal (MCJ)

MyCryptoJournal is a dedicated crypto trading journal that lets you add trades in two ways: manually or automatically using the inbuilt API manager. The API connects MCJ with your favorite exchange. Once you do this, MCJ will automatically update trades as soon as you make them.

MCJ is a basic journal provider that offers the following features:

-

Risk/reward ratio and profit/loss ratio calculations.

-

Screenshot upload option.

-

A section in which you can input the reasons for entering trades.

-

Position size (quantity).

-

Average entry price.

-

Performance report.

However, MyCryptoJournal sometimes experiences service interruptions that hinder essential processes and procedures such as registering and logging in. It does not offer a lot of information on its homepage, giving the impression that it is a new service.

Trader Logbook is another promising crypto trading journal dedicated to cryptocurrency trading. However, it is still under development.

Bottom line

A crypto trading journal is a must-have if you are to succeed in crypto trading. While you can record trades using an Excel spreadsheet, the convenience of professional online crypto trading journals is unmatched. However, journaling does not stop with creating an account with any of the five platforms listed herein. It also involves taking the time to analyze the reports generated to establish a pattern in your moves and identify mistakes. Otherwise, you would be setting yourself for consecutive losses and failure. You could also combine your insights with crypto trading signals from expert traders, to further hone your skills.