The Ultimate Beginner's Guide to Cryptocurrency Trading

In this guide, I will provide readers with the basic tools necessary in order to get started on their journey in cryptocurrency trading. Depending on the reception this guide gets, it is my intention to release more guides, with more advanced techniques. The four main areas I'll cover today are:

- The Economics of Cryptocurrencies

- Order Book & Stop Losses

- Technicals

- Practical Trading Advice

The Economics of Cryptocurrencies

In this section, I am going to introduce you to some of the basic economics of cryptocurrencies. Some of these concepts will be unique to the cryptocurrency market, but some will have been abstracted from more traditional investment markets.

The main intention of this section is to explore some of the factors that affect the price movements of a cryptocurrency. These factors include, but are not limited to:

- Supply & Demand

- Utility

- Market Sentiment

- Mining Difficulty

Supply & Demand – Starting with the fundamentals, supply and demand is a factor that certainly affects the price of a cryptocurrency. Bitcoin is the most well-known, and therefore, the most sought-after cryptocurrency. With a circulating supply of 16.7 million coins, the number of bitcoins available is quite low when compared to its peers.

This low supply, when weighed against the staggering demand Bitcoin has seen in the past few months, is believed, by some, to be the reason for Bitcoin’s surge in price.

Utility – In this context, utility simply means the usefulness of a cryptocurrency. The more useful a cryptocurrency is, the more likely it is to be perceived as valuable, and therefore, the more likely it is to be bought. Using Ethereum as an example, people believe it be useful because of the platform that it provides in allowing people build decentralized applications on top of. This novel use of blockchain technology as a sort of app store, as opposed to a medium of exchange, has been perceived by some to be very useful. And so, Ethereum can be said to have high utility and therefore be seen as valuable.

Market Sentiment – As a cryptocurrency trader, it is likely that you will switch between multiple positions at a high frequency. Therefore, it becomes key that any position you take is well researched and has a positive market sentiment surrounding it. This is where it becomes important to read recent articles on a cryptocurrency you intend to take a position in. If you invest in a cryptocurrency that has had no real coverage, it is likely that your position will stagnate, or even worse, decline in value. Getting a clear view on the sentiment surrounding a cryptocurrency allows you to screen the useless cryptocurrencies that are unlikely to experience any movement in price.

Mining Difficulty – Mining difficulty is simply a measure of how hard it is to be the next person that gets to add a block to the blockchain, and receive the reward for doing so. A lower mining difficulty indicates that a cryptocurrency is easy to mine; this results in an increase in the rate of supply, and therefore, downward pressure on its price. Conversely, a higher mining difficulty suggest that a cryptocurrency is harder to mine; this results in supply growing at a slower rate, therefore resulting in upward pressure on the price.

Order Book & Stop Losses

In this section, we are going to cover another key element of being successful at cryptocurrency trading, order book and stop losses.

Order Book

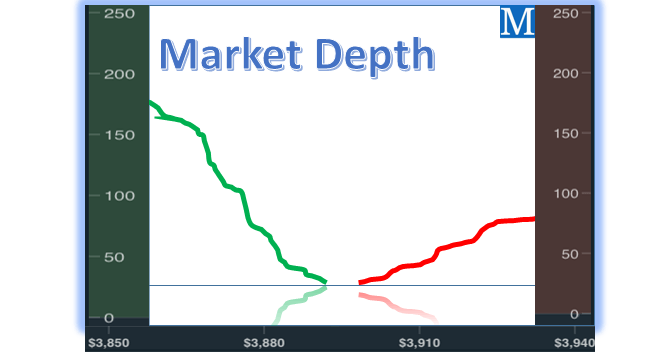

An order book is the number of buy and sell orders that have been placed at a particular price for a cryptocurrency. The order book is updated in real time and so can be a very useful tool in gauging the sentiment around a cryptocurrency. The order book is also known as the market depth, and can be used to provide an indication of the liquidity of a cryptocurrency. Liquidity refers to the ability of a cryptocurrency to bought and sold quickly without affecting the price. The larger the trading volume of a cryptocurrency, the higher the liquidity and vice versa.

The red line indicates the people who want to sell, and the green the people who want to buy. The dollar amounts on the x-axis is the price a market participant is willing to buy or sell a particularly cryptocurrency. While the y-axis indicates the number of cryptocurrency the buyer or seller wants.

For example, if Bob executed a trade for the sale of a single bitcoin for $3500, this would be classed as a market order and join the order book. Bob’s executed trade would sit in the order book until it was filled, i.e. until Bob’s trade was matched with another individual who is willing to purchase his one bitcoin at a price of $3500.

In terms of liquidity, more liquid cryptocurrencies tend to be preferred by traders because it means when they attempt to exit a position, they will not negatively affect the price. In addition, more liquid cryptocurrencies are significantly harder to manipulate, making them less likely to fall prey to pump and dump schemes that are prevalent within the cryptocurrency space.

If you are ever worried about the liquidity of a cryptocurrency, make sure to look at the order book to get a sense of the market depth.

Stop Loss

A sell stop loss is placed on top of a cryptocurrency trade that executes a sell order when the cryptocurrency reaches a certain price. Sell stop losses are placed below the buy-in price and are an effective tool in mitigating risk. In such a volatile market like cryptocurrencies, a sell stop loss is key because it is designed to limit your potential loss on an investment. Conversely, buy stop losses allow you to collect profits if your cryptocurrency were ever hit a certain price above your buy-in price. They are incredibly useful for capturing gains in times of volatility.

For example, if Alice bought the cryptocurrency, ether (Ethereum), at a price of $100 per coin, but she was worried about the price falling below 10% of her initial buy-in price, then she can employ a sell stop loss. Alice enters a stop loss price of $90, and if the price of one ether hit this price point, her holdings will be processed into a market order waiting to be filled. The process is exactly the same for a buy stop loss, except the stop loss price must be above the buy-in price.

Technicals

In this section, we are going dive into the world of graphs and lines, otherwise known as technical analysis (TA). Technical analysis may seem scary, but it is actually very straightforward. TA is simply the use of historical trends to try to predict future price movements.

Relative Strength Index (RSI)

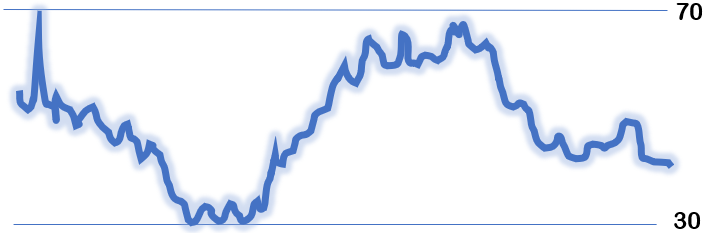

RSI measures the strength and speed of a market’s price movement by comparing the current price of a cryptocurrency to its past performance.

RSI compares the magnitude of recent gains to recent losses in an attempt to discern if a particular cryptocurrency is overbought or oversold.

The RSI ranges from 0 to 100. A cryptocurrency is said to be overbought once the RSI starts to approach 70. This suggests that the cryptocurrency is getting overvalued and so may soon experience a pull back. Conversely, if the RSI approaches 30, this is an indication that the cryptocurrency may be oversold, and thus is undervalued. This indicates that the cryptocurrency may be subject to a breakout at some point soon.

RSI is useful indication for when a market will reverse. However, false buy and sell signals can be created by large rallies or drop in the price of a cryptocurrency. This is where it becomes incredibly important to combine the RSI with other trading indicator signals.

The Moving Average Convergence/Divergence (MACD) Indicator

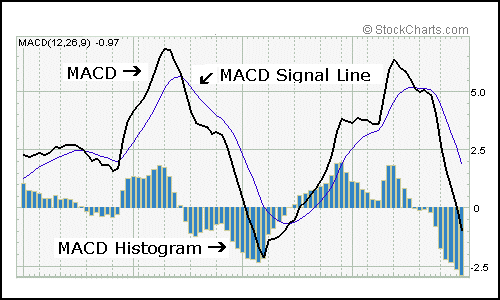

The MACD indicator is made up of two exponential moving averages that help measure momentum in a cryptocurrency by using the difference between short-term and long-term price trends to help predict future trends.

These two moving averages, and the distances between them, become the moving average convergence/divergence (MACD).

Convergence simply means that the two averages are moving closer to each other, and divergence that they are moving further away from each other.

One thing traders should look for when cryptocurrency trading using the MACD indicator is crossovers. When the MACD crosses above the signal line, this tends to be a bullish signal to buy the cryptocurrency. Conversely, when the MACD crosses below the signal line, this tends to be a bearish signal to sell the cryptocurrency.

Bollinger Bands

A Bollinger band is simply a moving average with two standard deviations plotted from it on either side. Standard deviation is simply a measure of market volatility and so Bollinger bands help account for volatility in a cryptocurrency.

When the cryptocurrency is a more volatile, the Bollinger bands widen, and move further away from the average. During periods of reduced volatility, the bands contract and move closer to the average. Thinner bands indicate that the market may soon experience large amounts of volatility.

When the price approaches the edge of the band, it is likely the price will reverse and come back within the range of the Bollinger bands, traders can use this as a signal to buy or sell a cryptocurrency.

For example, if the price approaches the upper edge of the Bollinger band, this is a signal that the cryptocurrency is overbought and thus will experience a correction. Similarly, if the price approaches the lower edge of the Bollinger band, this is a signal that the cryptocurrency is undervalued and will experience an appreciation in price.

Practical Trading Advice

In this section, I intend to give more practical advice. Advice such as: which cryptocurrency exchanges to use, the best way of keeping your cryptocurrency safe, and which forms of social media you should use in-order to increase your chances of being a successful trader.

Exchanges

A cryptocurrency exchange is a platform that allows you to buy and sell cryptocurrencies. However, there are some distinct differences between some cryptocurrency exchanges that you will need to know.

A cryptocurrency exchange that allows you deposit and withdraw fiat straight from your bank account is known as a fiat gateway. By fiat I simply mean currencies such as: USD, GBP, and EUR. In essence, fiat is what you use every day to buy your groceries or pay the bills. Fiat gateways are important because they provide the means for you to actually get your money to a point that enables you to buy and sell cryptocurrencies. Popular fiat gateways include:

- Coinbase

- io

- Kraken

- Gemini

- Bitstamp

Fiat gateways can often be limited in the number of cryptocurrencies that you can trade with. For example, Coinbase only supports 5 cryptocurrencies: Bitcoin, Ethereum, Ethereum Classic, Litecoin and Bitcoin Cash. Therefore, it is often necessary to use other exchanges that support a wider range of cryptocurrencies. These exchanges include:

- Bitfinex

- Bittrex

- Binance

- Poloniex

One downside of needing to move money between multiple exchanges are the fees. It therefore becomes important that you only move your cryptocurrency between exchanges when you need to. Excessive movement of money can easily result in fees eating into a large chunk of your profits.

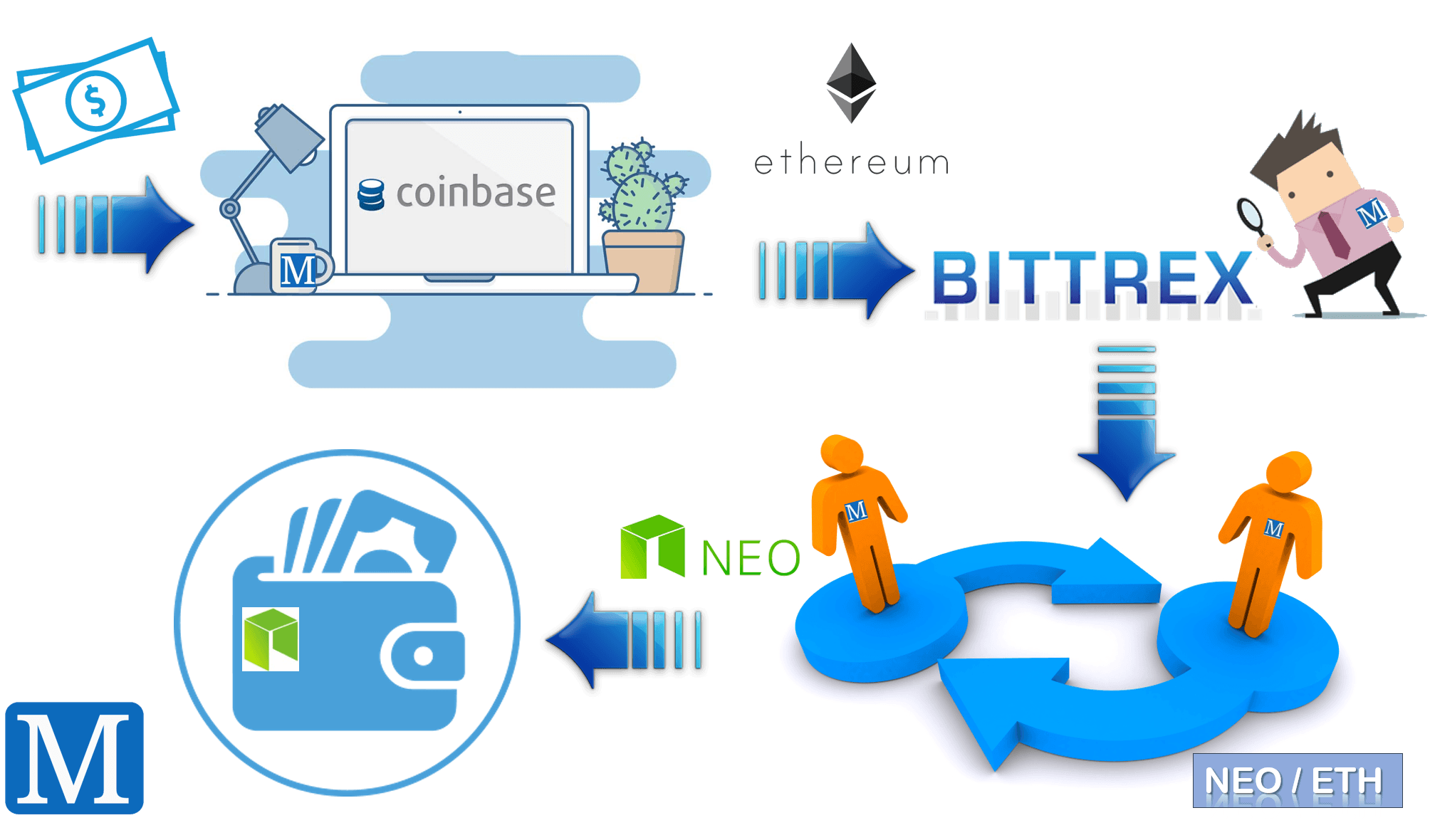

Here is an example illustration of how you can move your money around in order to purchase a particular cryptocurrency:

In my example, I am making sure to buy ether (Ethereum) as opposed to bitcoin for two reasons: Lower network fees and a faster transaction time. For reasons I will not go into now, purchasing and sending ether will result in it arriving quicker and me paying less in fees than if I had used bitcoin.

However, this is not to say that you can use any cryptocurrency as a medium for exchange between cryptocurrency exchanges. It is important that the exchange supports the relevant trading pair. For example, if I wanted to buy NEO using ether, I would need to make sure that Bittrex supports the NEO/ETH trading pair, or else I would be unable to purchase NEO using my ether.

Social Media

Social media is an incredibly powerful tool for staying up-to-date with your investments, as well as for finding new ones. The cryptocurrency market is still so small that even a tweet by an influential player can add a few percentage points to a cryptocurrency.

The three key social media platforms that I would recommend include:

- Telegram

Telegram – Similar to WhatsApp, Telegram is a private messaging service that allows you to create and join group chats with thousands of people. A lot of cryptocurrencies within the space tend to have their own Telegram channel that you can join in order to stay up-to-date with the latest developments. In addition, Telegram is useful for learning from people who are more experienced and great place to go to receive free trading signals from expert traders. Even if all you do is lurk and never comment, you can still learn some neat tricks.

Reddit – A breeding ground for cryptocurrency maximalists, Reddit is a necessary evil if you want to make sure you’re not missing out on any important news stories. If you only care about one cryptocurrency e.g. Bitcoin, then you can exclusively follow the Bitcoin related subreddits such as: /r/Bitcoin and /r/btc. However, you have to be careful of the herd-like mentality exhibited by some of these subreddits, take some of the information you come across with a pinch… or tub, of salt.

Twitter – As previously mentioned, a tweet by an influential figure can move a cryptocurrency to green or to the red. Therefore, it becomes important to make sure that you are following the key individuals within the cryptocurrency space, as well as the official twitter account of the cryptocurrencies themselves. One thing that I like to do is to turn on the Twitter notification for the important accounts so I get notified immediately after a tweet is sent out.

Keeping Your Cryptocurrency Safe

Once an investor has successfully begun cryptocurrency trading, it is not unusual for them to simply leave the cryptocurrency on an exchange in hopes that their investment will turn a profit. However, this is a dangerous practise to engage in as cryptocurrency exchanges are prone to hacks that could see investors lose all of their funds. Notable hacking of cryptocurrency exchanges includes: MtGox and Bitfinex.

Despite this, there is a secure method that you can use in order to keep your cryptocurrency safe. One of the most effective ways of securing your cryptocurrency is the use of a hardware wallet. A hardware wallet is a physical device that secures your cryptocurrency by securing the private keys used to access them. Popular hardware wallets include:

- TREZOR Wallet

- Ledger Nano S Wallet

- KeepKey Wallet

Hardware wallets are a great way of storing your cryptocurrency if you intend to hold it long term. However, if you want trade a bit more actively than that, then it is usually recommend keeping some of your cryptocurrency on an exchange, but a majority offline.

Conclusion

To conclude, cryptocurrency trading can be incredibly lucrative if you are well equipped to take advantage of the volatility that currently exists within the market. It is not usual to see videos and news article discouraging people from cryptocurrency trading, something I do not necessarily agree with. Instead, you should approach cryptocurrency trading with an open mind and only invest what you can afford to lose.

This guide is simply meant as a primer to get you started on your journey in cryptocurrency trading. This guide, however, is not the be all and end all when it comes to cryptocurrency trading; you should always try to seek new ways to improve your trading strategy and knowledge.

I hope you found this guide to be useful!