StellarX

Last Updated: 30th October 2018

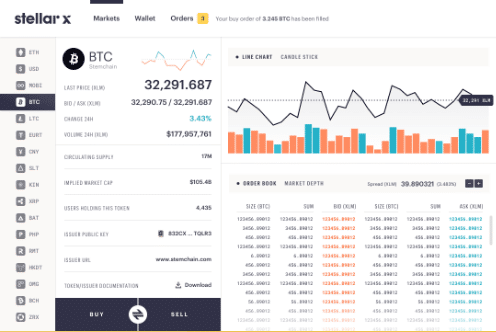

StellarX is a trading platform that uses the Stellar protocol, more specifically its decentralized exchange, or SDEX, to function.

The recently announced project aims to facilitate for a seamless trading experience of any asset, including: crypto-assets, fiat, tokenized securities and even carbon credits. The platform utilizes Stellar’s universal order book in order to provide enough liquidity for its platform, and allow trades to occur in a peer-to-peer fashion without a centralized entity. Market makers stand to receive a portion of 100,000 XLM, or $20,000, that is distributed each week to top market makers for providing tight spreads for assets traded on its platform.

Because trades happen directly between individuals, users keep control of their private keys and therefore do not rely on the StellarX platform to custody their digital assets. In addition to this, trades placed on the platform are free. This is because transaction fees on the Stellar network are inherently low with only 0.00001 XLM being required for each transaction placed. Therefore, every week, StellarX refunds all network fees incurred by users in a single payment. Stellar transaction fees act as a deterrent for bad actors by requiring an economic stake to be made in the form of a fee in order to conduct a transaction. Furthermore, StellarX platform commits to redistributing any inflation pool rewards to users who hold any Lumens (XLM) on its platform.

The platform aims to be open to the public by the end of the summer.

Getting Listed on StellarX

Creators of their own crypto-tokens stand a chance to be listed on StellarX depending on how compliant they are with the guidelines listed in the stellar.toml file.

The Stellar.toml file is a document that details all the information relating to a company and its token issuance. It serves as means of legitimizing token offerings made on the Stellar network by requiring issuers to provide information such as: the organization’s name, a physical address, Github repo and more.

How much information a token issuer presents is dependent on them, however, the more information they present, the more likely it is that their token will be listed on StellarX.

Under the Hood of StellarX

StellarX is the front-end of the Stellar’s decentralized exchange, which it interacts with through Stellar Core and the Horizon API.

Stellar Core is akin to Bitcoin nodes on the Bitcoin network. They are responsible for validating and coming to consensus on the state of transactions on the Stellar network. Stellar Cores are operated by a mixture of individuals and corporations who provide additional decentralization as well as security to the network. Stellar Cores are not to be mistaken with Stellar Anchors.

The Horizon API allows StellarX to provide core functionalities to its platform through use of a subset of APIs:

- Transactions API

- History API

- Trading API

Transactions API – This API permits applications to create and then submit valid transaction to the Stellar network

History API – This API is responsible for documenting and retrieving past transactions on the Stellar network. It allows a developer to retrieve transaction details, as well as load transaction information pertaining to a specific account.

Trading API – This API in effect retrieves all pertinent information regarding the order book of the decentralized exchange. It provides key trading data such as: the time of the trades, size of the order and more.

More information on the Horizon API can be found on Stellar’s GitHub.

Conclusion

To conclude, StellarX is a recently announced front-end platform for the decentralized exchange inherent to Stellar network. StellarX is not a decentralized exchange as it does not have its own order book or trading system, it relies on Stellar’s decentralized exchange for both.

StellarX aims to facilitate for the trading of a myriad of assets from crypto-assets to traditional capital market assets such as stocks and bonds. It works by interacting with the Horizon API which allows it to submit transaction information to the Stellar network, retrieve past transactions of users, and access trading data in the decentralized exchange’s order book.

Furthermore, in order to be listed on StellarX, token issuers must provide detailed information on themselves such as their physical address and organization email address.

More information on StellarX can be found on their website.