Dharma Protocol is a decentralized finance application operating on the Ethereum blockchain; it allows for the creation and trading of digital lending products by tokenizing debt. It is part of a new wave of decentralized finance products that seek to democratize access to financial services.

The key players within the Dharma ecosystem include: debtors (borrowers), creditors (lenders), underwrites and relayers. Debtors, individuals who would like to receive a loan, can approach creditors and receive one in exchange for paying back the initial amount plus interest. Underwriters on the Dharma platform help debtors structure their loans by providing key pieces of information such as: risk level, negotiating terms and the interest rate. Lastly, relayers help in finding creditors to fund loan applications by hosting it on their global order book.

How Does Dharma Protocol Work?

At a fundamental level, Dharma operates on-top of various smart contracts known as the Dharma Settlement Contracts. Each play a different role in the operation of the platform and is crucial to its functionality. One of those key contracts is the Terms Contracts.

The Terms Contracts is used to define the terms in a debt agreement between two individuals. For example, if Bob agrees to receive a loan from Alice at 5% interest to be paid monthly, then the terms of that agreement is codified in a Terms Contract. This provides the benefit of allowing any potential future disputes to be more easily resolved, as proof of the agreement between both parties is recorded on an immutable ledger.

When a creditor and a debtor enter into a debt agreement, a signed cryptographic message called a Debt Order is then submitted. If the Debt Order is valid, then the loan amount is transferred from the creditor to the debtor, at which point a unique token known as a Debt Token is minted to the creditor. Ownership of a Debt Token entitles the owner to all the repayments of the loan from which the token was minted from. Debt Tokens are tradable and thus can be exchanged between individuals in an open market place.

Defaults, Collateralized & Uncollateralized Loans

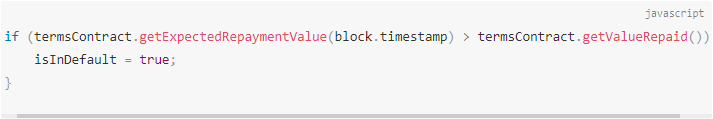

Defaults occur when a borrow is unable to make their loan repayments to a creditor as agreed to by their Terms Contract. On the Dharma Protocol, a loan is considered to have entered into default when the expected amount repaid exceeds the actual amount repaid at any point in time.

Collateralized loans are a mechanism by which creditors can recoup somewhat the value of their loan if the borrower was ever to default. To illustrate, consider that Alice and Bob enter into a debt agreement in which she lends Bob 5 ETH. Bob agrees to put up 2 ETH as collateral such that if he was ever to default on the loan, the 2 ETH would then be transferred to Alice. Collateralizing a loan reduces the risk to the creditor as it guarantees that they will recoup some of the value of their loan upon a debtor’s default.

This is in contrast to Uncollateralized Loans in which no asset has been put up by the borrower upon entering a loan agreement. Uncollateralized Loans are considered more risky than their counterpart, collateralized loans, as the creditor has no way of recouping any value of their loan amount if the borrower were ever to default. However, the Dharma Protocol utilizes a key player in its ecosystem known as an Underwriter, that makes it less risky for creditors to enter into uncollateralized loan agreements.

Underwriters

Underwriters are trusted third-parties that help facilitate loan agreements between borrowers and lenders by making a prediction as to how likely it is that a borrower will be able to successfully make their loan repayments. Underwriters receive a fee for providing such a service. Dharma Protocol implements a reputation system wherein each Underwriter is assigned a rating depending on the previous accuracy of their predictions. This incentivizes Underwrites to make accurate predictions so as to maintain a good reputation and therefore increase their ability to earn more fees. Predictions made by Underwriters are permanently recorded on the blockchain and is then associated with their public key, allowing anyone to see the accuracy of their previous predictions.

Debt Orders & Relayers

A Debt Order on the Dharma protocol is a representation of an individual’s intent to borrow a certain amount. A Debt Order is said to be filled when a creditor agrees to the terms outlined in the Debt Order by the borrower. A Debt Order is considered filled when it has been signed by both the borrower and lender. The signature of an Underwriter will also be required if one was involved in facilitating the loan.

Relayers are another key player in the Dharma Protocol ecosystem because they help borrowers find creditors to fill their loans by hosting their Debt Order in an open order book. Relayers then receive a fee for every loan that is successfully matched to a creditor. One example of a relayer currently operating on Dharma Protocol is Bloqboard.

Conclusion

To conclude, Dharma protocol is an open financial protocol that aims to democratize access to lending products through its decentralized lending platform. According to DeFi Pulse, an analytics platform for decentralized finance applications, a total of $13 million dollars have been locked up in the protocol. This serves as an indication as to the value that has been transacted over the platform.

Through its ecosystem of lenders, borrowers, underwriters and relayers, it aims to provide a viable alternative to today's modern financial system. Virtually any type of loan can be created on the Dharma Protocol; from regular consumer loans to corporate bonds.

However, Dharma Protocol is not the only decentralized finance project operating in the lending space. There includes other such as: Compound Finance and Ethlend.