What are Decentralized Finance (DeFi) Applications?

Decentralized Finance Applications, or DeFi applications, are pieces of open-source technologies that aim to improve on different aspects of the current financial system through the introduction of a decentralized layer in order to disintermediate rent-seeking middlemen.

Using cross-border payments as an example, when an individual makes a payment to a person located in another country, a financial institution would help facilitate this payment and in return take a fee for doing so.

However, DeFi applications can disintermediate the entire process by having an individual send a digital currency from his or her wallet to the intended recipient without the aid of a financial institution sitting in the middle.

What are Decentralized Applications?

DeFi applications are a subset of a new application type known as decentralized applications. A decentralized application, or DApp, is an application that runs on a peer-to-peer network of computers, as opposed to a single computer. The key benefit of this is, users of the network no longer depend on a central computer in-order to send and receive information.

In order to fully understand the difference between a decentralized application and a centralized application, consider some examples of centralized applications such as: Facebook, Twitter and YouTube. These are all examples of centralized applications because in-order to use them, the user is dependent on a network owned and operated by a central entity.

Decentralized applications have many use cases, from prediction markets (Augur), to games (CryptoKitties) and finally lending (Dharma Protocol). However, the commonality between all decentralized applications is the disintermediation of middlemen through the introduction of decentralized network architecture such as a blockchain or a tangle.

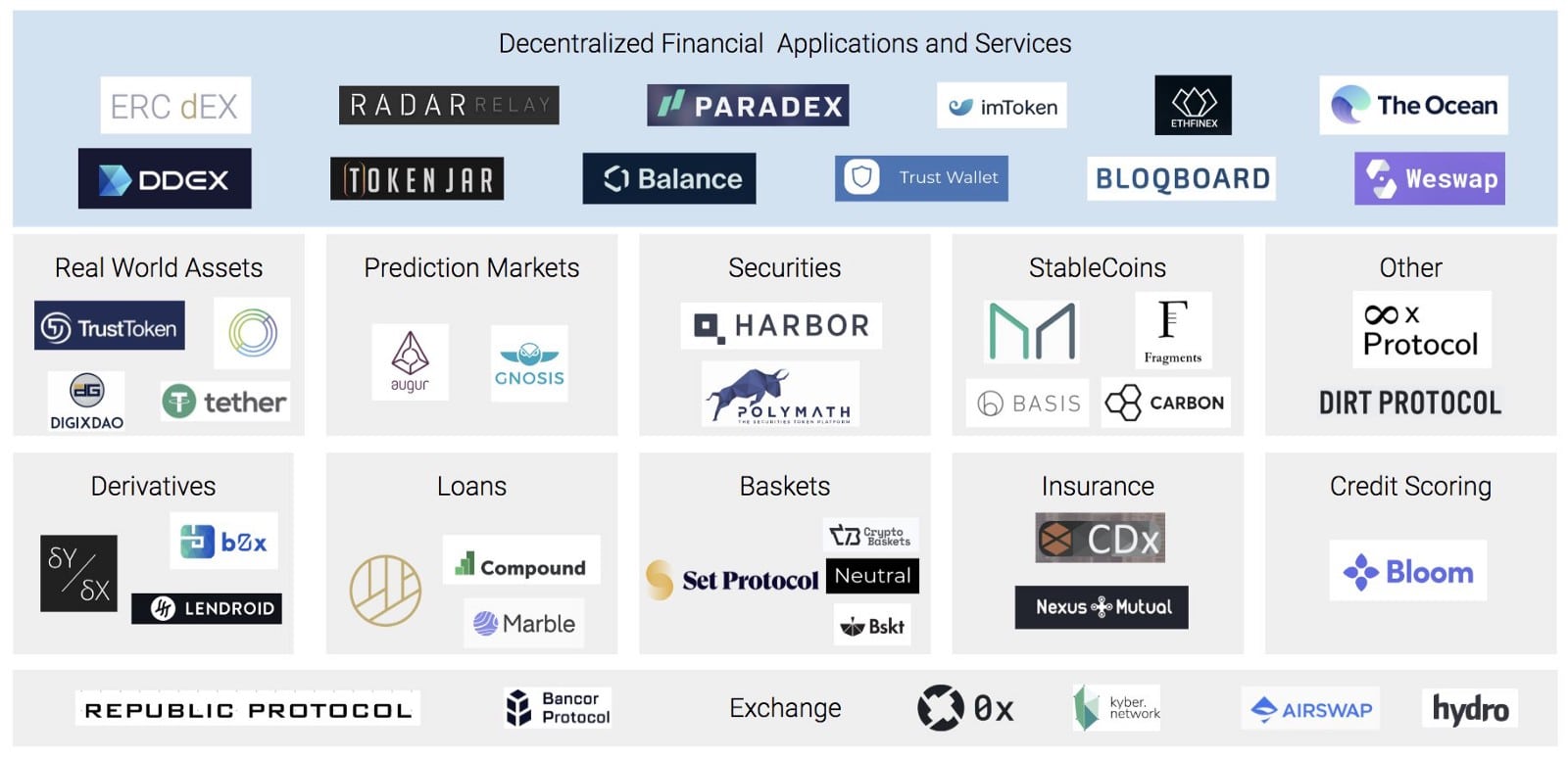

Different Forms of DeFi Applications

Just like how there exists many different use cases of decentralized applications, there too exists many different use cases for DeFi applications. Examples include:

- Payments

- Lending

- Stablecoins

- Tokenization

- Decentralized Exchange

Payments – Counterparty is a protocol that uses the Bitcoin blockchain to allow any individual to create and trade their own digital token. These types of DeFi applications tend to have their own native digital currency with which users can use to transact with, as well as offer a wallet address in order for users to hold their digital currency.

Lending – DeFi lending applications are another attempt at decentralizing a core function of a financial economy. Instead of an individual going to a bank to secure a loan for a house, for example, DeFi lending applications aim to democratize the entire process by allowing the individual access to a much wider pool of willing lenders. One example of a DeFi application currently working in the lending space is the Dharma protocol. Built on top of the Ethereum blockchain, Dharma allows participants to lend and borrow different forms of collateralized debt.

Stablecoins – A stablecoin is an asset that offers price stability characteristics making it suitable for certain functions such as: a medium of exchange, unit of account, and a store of value. Stablecoins have seen increasing interest in the digital asset space due to their function of providing price stability to otherwise volatile assets such as Bitcoin, Ethereum and other digital assets. Tether was the first ever released stablecoin that provided a 1-to-1 backing of each Tether issued to 1 USD. However, since the controversy that the stablecoin has run into surrounding its solvency, other stablecoins such as: MakerDAO, Gemini Dollar (GUSD) and Circle (USDC) have since been launched.

Tokenization – Tokenization is the process of utilizing blockchain technology to digitize a real-world good or service. Security Token Offerings (STOs) use the idea of tokenization to digitize and represent ownership of financial assets such as a stock or bond. Harbor is a DeFi project that through the use of its R-Token, facilitates for the issuance and trading of tokenized securities. The R-Token is an ERC-20 token that was created using the Ethereum platform.

Decentralized Exchange – Decentralized exchanges are a platform that allows users to trade digital assets such as Bitcoin and Ethereum. Decentralized exchanges are a response to centralized exchanges and the issues that can arise with using one; namely, the fact that users have no control over funds deposited as they do not own their private keys. 0x, a DeFi application built on top of the Ethereum blockchain that is an example of a decentralized exchange that allows users to trade digital assets while also still being in control of their private keys.

Problems That DeFi Applications Solve

That are two main problems that DeFi applications aim to solve that more centralized services fail to do so. These include:

- Unequal access to finance

- Financial censorship

Unequal access to finance – This refers to the ability of individuals to gain access to financial services such as: loans, mortgages and insurance services. Those with limited or no access to financial services are referred to as the unbanked. DeFi applications aim to ameliorate this problem by ensuring that there exists little to no barriers as to who can use their applications; all an individual would need is a smartphone and an internet connection.

Financial censorship – This is when governments, financial institutions or intermediaries close down an individual or a company's accounts and limits their ability to transact for a specific gain. For example, by a government purposefully restricting the financial access of a company who publicly disagrees with their policies, they can silence the company by preventing access to basic financial services. Services such as their bank account, which they would need to pay their employees as well as other costs; failure to do so would eventually result in the bankruptcy of the company. Conversely, because DeFi applications are inherently decentralized, their exists no method of financially censoring those who use them. Using lending as an example, if a financial institution wanted to censor an individual, they can limit his/her access to credit by rejecting their application for a loan. However, with decentralized lending protocols such as Dharma, the individual no longer has to rely on that institution for a loan, they would instead have access to an international pool of willing lenders.

Popular DeFi Apps

There are some decentralized finance applications that have gotten more attention than others, some have already been mentioned in this article. The more popular DeFi apps currently in the ecosystem include:

- MakerDAO

- Dharma Protocol

- Uniswap

- Bloom

- dYdX

MakerDAO

MakerDAO is a decentralized autonomous organization that operates on top of the Ethereum blockchain. Through its dual coin system, Maker (MKR) and Dai (DAI), the platform aims to bring price stability to digital assets.

- Maker (MKR) – This is the utility token of the MakerDAO platform, with its function being for token holders to use in order to govern the platform. The Maker token is not pegged to any specific price, and so, the price is free to fluctuate like any other digital asset.

- Dai (DAI) – This is the stablecoin of the platform that has its price fixed around $1. Unlike its sister token, MKR, DAI is designed not have a volatile price and thus allow users to hold the token without fear of it losing its value.

More information about the MakerDAO project can be found on their website: MakerDAO

Dharma Protocol

Dharma is another decentralized finance application, operating on the Ethereum blockchain, that allows for the creation of digital lending products by tokenizing debt.

Debtors, individuals who would like to receive a loan, can approach creditors and receive one in exchange for paying back the initial amount plus interest. Underwriters on the platform help debtors structure their loans by providing key pieces of information such as: risk level, negotiating terms and the interest rate. Lastly, relayers help in finding creditors to fund loan applications by hosting it on their order book.

Although Dharma initially appears to be similar to any other traditional lending platform with respect to the typical players such as creditors and lenders, the key differentiator it possesses is access. Dharma is completely free and open for any individual to use in order to secure a loan. This is in antithesis to the modern financial system which can restrict participation of those with lesser means.

More information about the Dharma Protocol can be found on their website: Dharma Protocol.

Uniswap

Uniswap is an Ethereum-based protocol that is designed to facilitate for the trading of Ether (ETH) and ERC20 tokens. Uniswap is completely on-chain, and individuals can make use of the protocol as long as they have MetaMask installed. The platform seeks to leverage its underlying decentralized architecture in disintermediating middle-men that are involved in the exchange of digital assets.

The design architecture of the Uniswap protocol differs to the model found within traditional digital asset exchanges. Most traditional exchanges maintain an order book and use that to match buyers and sellers of a given asset. Uniswap on the other hand, utilizes liquidity reserves in facilitating the exchange of digital assets on its protocol. The reserves in exchange contracts are supplied by a network of liquidity providers.

A more detailed guide on the Uniswap protocol can be found here: What is Uniswap? A Detailed Beginner's Guide.

Bloom

Bloom is a decentralized credit scoring and identity verification protocol built on top of the Ethereum blockchain; the platform aims to provide an alternative and fairer way of assessing the creditworthiness of individuals.

The key issues that the Bloom protocol aims to address are: high-risk of identity theft that arises when filling out a loan application, inability for credit histories to be portable across different countries, and lastly, better accommodate users who are new and have no previous credit history.

The network’s token is Bloom Token (BLT) and is used to compensate third-party participants of the network who provide key services such as identity verification and risk assessment.

More information on the Bloom protocol can be found on their website: Bloom.

dYdX

dYdX is a decentralized exchange that facilitates for the trading of derivatives based on cryptocurrencies. A derivative is a financial instrument whose value is derived from another underlying asset. Therefore, in the case of dYdX, it aims to build an exchange which allows for the trading of derivatives whose value has been derived from digital assets.

The project is built on top of Ethereum and 0x and consists of a number of a protocols that specify operation and execution of different types of financial products on its platform. Protocols currently being implemented include: Margin Trading Protocol and an Options Protocol. The Margin Trading Protocol would allow users to short assets and profit on price decreases, and the Options Protocol would allow users to write, buy or sell an option based on a cryptocurrency.

More information on the dYdX protocol can be found on their website: dYdX.

Conclusion

To conclude, DeFi applications are open-source technologies that aim to disintermediate and democratize the current financial system. Different facets of the financial system that stand to be disrupted through the introduction of a decentralized network architecture include payments, lending, stablecoins and many others such as derivatives and indexing.

The two key problems that DeFi applications can help solve is inequality with respect to financial access, as well as financial censorship. Currently, some of the most popular DeFi projects include: MakerDAO, Dharma Protocol, Uniswap, Bloom, dYdX.

Some more DeFi projects that have not been listed in this article include the likes of: